For what reason is a Bill of sale Required in Texas?Ī bill of sale is utilized to record exchange and is expected by both the purchaser and vendor in the trading of an individual property. It can likewise be drawn up by private people, as long as it contains the fundamental data.

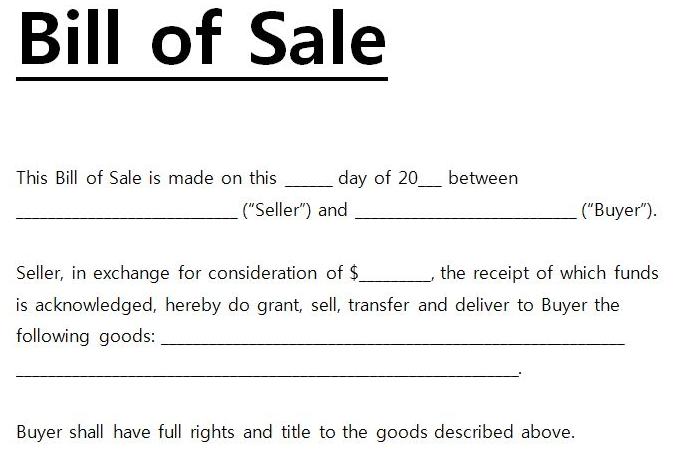

This report is accessible from administrative organizations, for example, nearby region charge collector’s offices or DMVs (for vehicles). This incorporates the date of the sale, the sale value, the complete name and address of both the purchaser and seller, a portrayal of the property being sold, and the marks of both the purchaser and the vendor. By doing this, a proper record of the trade is delivered, which might be introduced to any authority for affirmation or to resolve a debate.Ī bill of sale in Texas is commonly a report comprised of a few sections that should be loaded up with explicit data. By recognizing responsibility for resources and surrendering earlier responsibility, the purchaser and merchant each recognize their separate privileges by marking the bill of sale. A bill of sale is given by the vendor and endorsed by the purchaser to record the trading of any of these resources for a particular amount after an exchange is finished. This includes vehicles, boats, guns, or livestock. A bill of sale works very much like a receipt for some other commodity yet is explicitly applied to individual property. The deputy registrar will issue plates and tabs to put on their vehicle and complete the vehicle transfer.An official receipt for the trading of individual property between two individuals in the province of Texas is a Texas bill of offer.At the office, they can pay the registration and titling fees, and the registration tax.Assigned Vehicle Title for proof of ownership.Completed Title and Register Motor Vehicle Application.The following documents will be required of them at the office:.

0 kommentar(er)

0 kommentar(er)